COVID-19: The numbers were staggering, and the economic emergency is only just beginning

For months the chancellor has been spending huge sums on the COVID crisis.

On Wednesday, we not only got the bill but some idea about how long and hard the road back to recovery will be.

From the bail-out to the hard truths, the numbers Rishi Sunak presented to parliament were staggering.

The coronavirus bill came in at £280bn for this year and £73bn for the next (Paul Johnson of the Institute For Fiscal Studies noted it could be higher still given the spending review assumes zero spending on COVID after next year).

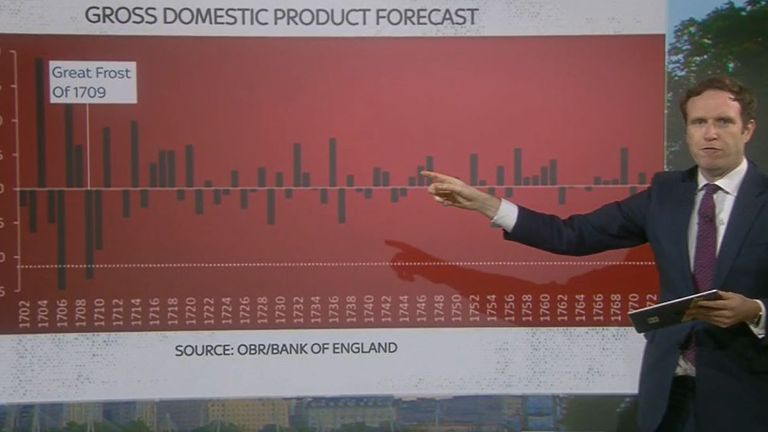

The economy has suffered its biggest contraction – 11.3 per cent – in 300 years while borrowing is forecast to a peacetime record £394bn this year.

Unemployment is expected to rise to 7.5% in the second quarter of next year. That’s 2.6m people without a job.

And if the public health emergency has an end point around Easter when a mass vaccination programme is underway and life can return to some form of normality (we hope), the message from the chancellor on Wednesday was that the economic emergency is only just beginning, while the long term scars of COVID-19 are permanent.

The economy will be 3% smaller in 2025 than was expected in the March budget.

The chancellor on Wednesday made it clear that his immediate priority is “to protect people’s lives and livelihoods”.

Still in the midst of an economic crisis, this is not the time for fiscal consolidation. But a warning too from the chancellor that there will come a time when we will have to start to repair the public finances.

“This situation is clearly unsustainable over the medium term… we have a responsibility, once the economy recovers, to return to a sustainable fiscal position,” he said.

There was a small taster of what is to come as Mr Sunak announced a pay freeze for public sector workers (although NHS staff and state workers on below-average pay were exempted).

There was a cut in the overseas aid budget, while Mr Sunak also reduced government spending plans from 2021-2022 onwards by more than £10bn a year, compared to plans set out in the March Budget.

But he won’t be able to duck the question of how and when he intends to get the public finances onto a more sustainable fiscal footing for that much longer.

The country will still be borrowing £100bn a year in 2025 and there will be at least a £30bn annual hole in the government’s finances by the middle of the decade, according to the Office of Budget Responsibility.

Tax rises and spending cuts look inevitable – and daunting: to plug that £30bn gap through income tax alone would require a 6p hike in the rate.

Inevitable, too, that the medicine required to begin healing our economy – be it spending cuts, freezes or tax rises, all come with painful political side effects.

It is made all the more difficult because of the prime minister’s manifesto promise not to raise income tax, national insurance or VAT in the lifetime of this parliament.

Breaking the election pledge not to cut the overseas aid budget has provoked a parliamentary backlash. Can you imagine the fall-out should the chancellor decide tax promises need to be broken too?

There will be those MPs who believe the country can grow its way out of the crisis (although the economic rebound will have to be spectacular for that) through stimulus and low taxation and another camp that believes taxes will have to rise.

Managing the economic fall-out of the COVID crisis was hard enough; managing the recovery is going to be perhaps even harder still.

Source: Read Full Article