Merger failure leaves Asda’s doors open for Amazon to knock

When Sainsbury’s and Asda announced plans for their blockbuster merger just over a year ago, every analyst in the City warned they would have trouble getting the deal past the Competition & Markets Authority.

Those warnings have proved prescient with the regulator’s decision today to block the deal.

Mike Coupe, the Sainsbury’s chief executive and the key architect of the merger, had three key arguments that he hoped would win the day.

The first was his pledge to cut the price of everyday household items by 10% should the merger go through.

The idea was that a company with the combined buying power of Asda and Sainsbury’s would have the muscle to beat up even global consumer goods giants like Unilever, Procter and Gamble and Kellogg’s on price.

The second argument was that the nature of the grocery market had changed dramatically. Sainsbury’s and Asda, both businesses with strong non-food arms, were not just competing with other food retailers like Tesco, Morrisons, Aldi and Lidl.

The regulator was urged to look not at the combined 31% share of the UK grocery market that the company would have – leapfrogging current market leader Tesco in the process – but at the far smaller share the enlarged business would have had of a wider retail market including not only the other grocers but the likes of Boots, Marks & Spencer and, of course, Amazon.

Both Sainsbury’s and Asda also pointed out that, since competition regulators last studied the narrower UK grocery market in detail, the complexion of that sector had changed considerably with the German budget retailers Aldi and Lidl grabbing a combined 14% share. Much of that has come at the expense of Asda and Sainsbury’s.

Mr Coupe’s third argument revolved around some other recent decisions made by the CMA.

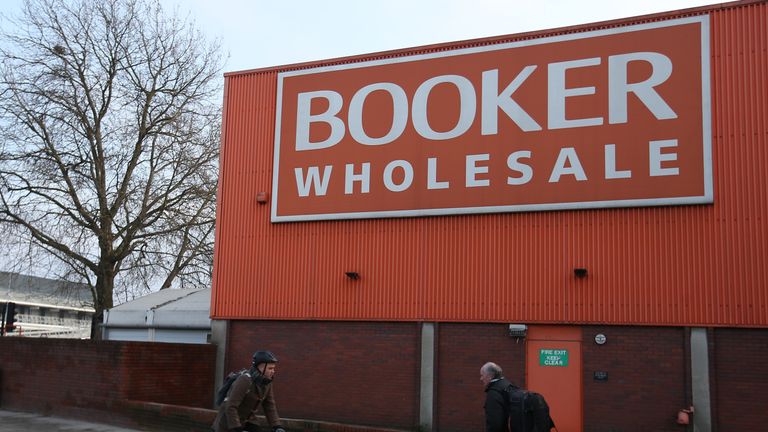

It had, he noted, just allowed the merger of bookmakers Ladbrokes and Coral – cutting the number of big high street bookies from four to three. He also pointed to the CMA’s decision, in November 2017, to allow Tesco to buy cash-and-carry giant Booker for £3.7bn – a decision that sparked incredulity among many of Tesco’s competitors and disbelief in the City.

Unfortunately, for Mr Coupe, the CMA was having none of it.

On the first point, it has effectively said it did not believe Asda and Sainsbury’s, arguing the merger was “more likely to lead to price rises than price cuts”.

A key element in its decision here appears to have been the dominance the combined business would have had in the petrol retail market.

The enlarged business would have been the UK’s biggest fuel retailer and, with Asda currently being one of the most aggressive competitors on price in the field, the CMA had fears competition would have been eroded.

On Mr Coupe’s second point, while the CMA satisfied itself that while the merger would not lead to a ‘substantial lessening of competition’ in clothing, electrical goods or toys, it was not enough to overcome the regulator’s broader concerns about a lessening of competition in the grocery market.

Significantly, it even warned of a possible reduction of competition in some instances where Sainsbury’s convenience stores were located near Asda stores, even though Asda does not even play in the convenience sector.

It also flagged a possible reduction of competition in online grocery deliveries – a field in which, apart from Sainsbury’s and Asda, only Tesco has near-national coverage.

As for Mr Coupe’s third argument, that appears to have fallen on deaf ears, with Sainsbury’s and Asda overlooking that the CMA is now under new leadership, in the shape of Andrew Tyrie, the prickly former chairman of the Commons Treasury Select Committee.

As Clive Black, the retail analyst at broker Shore Capital, put it: “At the heart of the proposed deal’s problems is an incorrect and over-extrapolation of the decision by the CMA, under a different managerial regime, to unconditionally clear the Tesco-Booker merger. We felt at the time that it was a surprising and poor decision.

“From this miscalculation, the merger parties did not assess the change of the guard at the CMA, most particularly the new chair, Andrew Tyrie.”

The big question is where this leaves the two businesses. Unsurprisingly, given the distraction to its top management, Sainsbury’s has seen its market share drift since it announced the merger. It has a lot of work to do now to remedy that.

Some investors will also inevitably call for Mr Coupe, as the key driving force behind the deal, to go.

Mr Black argues that would be unfair, on the grounds that in seeking the deal, Mr Coupe was only guilty of being too bold and over-ambitious for his company.

He believes the blame lies with the Sainsbury’s board and, in particular, its new chairman, Martin Scicluna, who was already a non-executive director of the grocer.

He added: “Where was the arm around the [chief executive’s] shoulder to say that it appears the game is up and maybe we should be focusing upon the day job, as our share demonstrably lags the whole market and not just the Big Four; never mind critically assessing a quite calamitous financial performance from Sainsbury Bank?”

Perhaps the bigger question concerns the future of Asda. This is a business that has palpably failed to live up to the expectations that WalMart had when it acquired it nearly 20 years ago.

:: Why Walmart is willing to check out of Asda

The decision to seek a merger with Sainsbury’s-WalMart would have been the biggest single shareholder in the combined entity but was widely expected to sell down its stake at some point in the future – was a clear indication of its willingness to offload Asda and eventually exit the UK.

So it would be no surprise to see private equity bidders dusting off spreadsheets and taking a look at a possible bid for Asda – although it can be argued that, if even the mighty WalMart cannot thrive in the intensely competitive UK grocery market, nobody else can.

Except, perhaps, another big US company that has plenty of financial firepower and which has recently extended its tentacles into grocery retail.

A move on Asda by Amazon would truly terrify every other player in UK retailing.

Source: Read Full Article